What is it like out there? Our Insights on the VC market

Written by Christopher Walsh, Partner @ 7GC & COLike all other trends in technology, it starts from the top and trickles down through the ecosystem. Companies like Tesla, Amazon, Google, TikTok, Snap, and Microsoft have conducted sizable layoffs in the first half of 2024, with no clear sign that we have fully troughed. The most notable goliath to announce a RIF is Intel – who, following its second quarter's earnings, announced a 15% cut in workforce, representing 15,000 employees.

Following significant workforce reductions in 2022 and 2023, 2024 saw over 130,000 job cuts across 398 tech companies. While we see some stabilization in data points, we continue to remain significantly elevated relative to FY21 and pre-COVID levels.

Within the private markets, we typically track Carta data to evaluate key hiring trends across the startup ecosystem. In March 2024, the total number of layoffs on Carta fell below 8,000 for the first time in any month since May 2022, a span of nearly two years. While positive, the data suggests a high skew with sharp upticks in January 2024, the second straight January with a sharp uptick in layoffs.

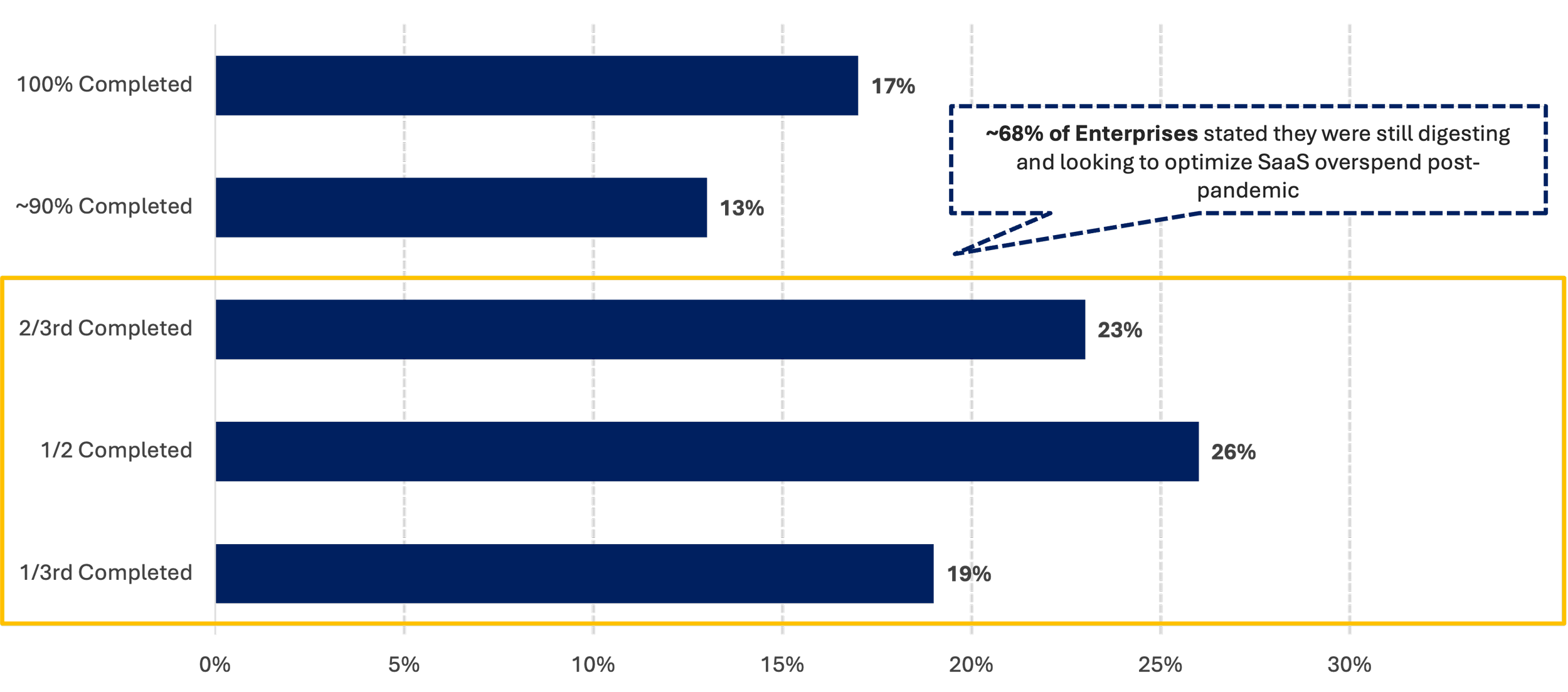

As discussed in the next section, there remains a massive glut of ZIRP-era unicorns, which will continue to pressure hiring growth over the next 12-24 months. This unicorn glut has been validated by tracking hiring trends across the 1,400 private market unicorns. Year-over-year headcount growth remains below 10% YoY, representing a 15-year low dating back to when the term "Unicorn" was coined in 2011. Further, many enterprises have made clear that they are still optimizing IT spend across their organization, with 68% of enterprises saying they are only between 33-66% optimized today.

IT Optimizations Across Enterprises Still are Yet to Be Completed for Majority of CompaniesSource: Avenir Growth Survey (N=74); June 2024Hiring is The Tip of the Iceberg for Something more systemic

Ten years ago, there were 25 VC-backed unicorns – a coin termed to define a private startup valued at over $1 billion. This 2014-2015 cohort raised their next round on average in <3 years and over 25% of these companies had a successful exit within, on average, 7 quarters following being designated as a horse with a horn between their eyes.

From 2014 to 2021, the term quickly lost its mystique with a proliferation of new technology verticals, COVID-19 spending, and a zero-interest environment (ZIRP). This flooded the market with three times more capital compared to historical averages, enabling established VC firms to raise record-breaking funds and introducing public "crossover" funds.

Where does that leave us today? With 1,420 private unicorns today.

Private Unicorns Ramped and Then Quickly Plateaued in 2022Source: Pitchbook, Coatue Management; as of July 2024In Q1 2022, the music finally stopped with rising interest rates and broad cost optimizations across technology spend, driving down multiples and budgets. Despite this public market correction, many unicorns priced in 2021-2022 have yet to be repriced and may never get new capital. The majority of these deals came from a concentrated cohort of firms, including Tiger Global, Softbank, Coatue, and Insight Partners. These four funds raised over $118B from 2019 to 2022, deployed over $100B, and led or participated in ~50% of all rounds priced over $1B at the time of the market top.

For some of these funds, we have visibility on fair value assessments based on required public disclosures like Softbank's Vision Fund II (SVF 2). The 2019 vintage fund raised $60 billion and today has a portfolio fair value of $31.2 billion, representing over $22.9 billion in cumulative investment losses. Many venture funds, however, are not held to the same reporting standards as a publicly traded conglomerate, leading to inflated TVPI statistics relying on many of these outdated unicorn rounds. The result has been a stubborn and slow step-down of TVPI for companies that will never grow into legacy valuation marks from 2021. Given that nearly two-thirds of unicorns from 2021-2022 cohorts have yet to raise new capital, we expect this to continue to move downwards for not only the big 4 (Coatue, Tiger, Insight, and Softbank) but also the rest of the venture ecosystem that was rewarded with this brief FMV uplift.

56% of all 2021 Unicorns Have Yet to Announce a New Financing Round SinceSource: Pitchbook; 2021 cohort defined as new unicorns that raised between 01.01.2021 through 04.01.2023 assuming 3-4 month deal announcement lagThis question mark on TVPI accuracy is validated by the LP secondary market within venture capital. While we have seen stability in other asset classes like buyout and credit, venture capital remains challenged. Pricing remained mostly flat in FY23, rising just 100 bps to 68% of NAV. Buyer feedback continues to be that "confidence in valuation remained low amidst the risk of down rounds in a challenging fundraising environment”.

While Other Alternative Asset Classes Have Rebounded, Venture Remains at a 7-Year LowSource: Eaton Partners; March 2024But These Startups Have had 3-4 Years to Grow into Their Valuations,There Should be Some Stars?

Herd mentality is true not only for deals but also within board rooms, which has been a detriment to many startups. While IT spend optimizations (highlighted above) have impacted many startups, many have also been subject to a reversal in ideologies from their lead investors. What was a strategy of "growth at all costs" overnight became "extend runway at all costs," leaving many startups in "no man's land."

While topline growth has fallen across the board from public software to early-stage companies, early-stage companies saw the biggest impact on ARR growth, falling from peak levels of 200%+ YoY growth to 111% YoY as of 1H 2023. Median net dollar retention has also been impacted, falling from peak levels of 130+% in 2017 to ~105% as of 1H 2023.

As growth has slowed across all companies, the standardized messaging from investors to companies was to reduce spend and conserve runway. While operating efficiency is critical, it makes it exponentially more challenging for a young startup to scale within a new vertical, especially as a first mover. It also begs the question of the sustainability of the startups market positioning at time of investment if a growth strategy is ripped from the table so quickly.

While Rule of 40 now has a higher correlation in public markets versus revenue growth, a startup is at a very different lifecycle stage. Without the proper growth levers, companies can lose first-mover advantage and cannibalize the company's future growth prospects.

Median EV / LTM Revenue multiples peaked in FY21 at 25.8x, and demand for private enterprise software deals followed suit, peaking at ~105x LTM Sales, representing a 4.1x premium to the public market. Despite the illiquidity of these assets, these companies were bid aggressively with the assumption that smaller-scale revenue would compound faster than public comps, and multiples would remain intact and not revert to the norm.

Spread Between Public and Private Markets Have Normalized from 2021-2022 LevelsSource: Redpoint Ventures; July 2024Fast forward to today, multiples normalized for high-growth companies falling 40-50% over the last 12-24 months. With multiple compression, growth resilience was absolutely critical for earlier-stage companies to drive value. In the public markets, we saw durability tilt to scale companies - with all the highest SaaS multiple businesses having an average of trailing $3.5B in revenue. The result is that many of these startups that raised rounds at elevated valuations did not compound at a rate necessary to grow into their valuation - this remains the case even 48 months later.

DPI > IRR

We are no stranger to the fact that venture capital remains challenged as an asset class for many of the reasons we have highlighted above. This asset class "hangover" will continue until the excess is fully digested – this will take time. From 2006-2022, 62 unique GPs raised 139 billion-dollar funds with commitments totaling $278 billion. In 2022 alone, commitments for $1 billion or greater funds amassed $93 billion, representing 57% of the total capital raised. For people keeping tabs, this also represents $1.9 billion in annual management fees for these GPs in FY22. This flight to scale continues to be a trend in the last 12 months, with mega-funds like Thrive Capital raising $5 billion and Kleiner Perkins raising $2 billion in fresh new funds this summer.

Given the current market round structuring and the overall venture capital market sizing post-ZIRP, we struggle to understand the deployment capabilities of these massive funds.

2018 – 2022 VC Vintage Year DPI vs. TVPI ComparisonSource: Pitchbook; 08.15.2024

While a "flight to scale" is one key barometer, the other central leverage point to differentiate among other venture participants downstream is distribution paid-in capital ("DPI"). While TVPI includes unrealized returns, distributions articulate a cash-on-cash return for LPs. From 2018-2022, top decile DPIs all remain below 1.0x. Ironically, scale doesn't translate for DPI. For all 4-year cohorts, DPI is higher for smaller funds relative to $1 billion megafunds. Despite the beat in DPI, megafunds exhibit higher TVPI in four of the five same cohorts. This trend is unsurprising to us based on the fact that many fatigued assets remain on these firm's books at unrealistic levels.

However, capital markets are cyclical and will be the catalyst for the asset class. While we are not macro experts, we have seen substantial institutional investor and retail public equity demand in the past 24 months led by technology investment. Whether we see a decline in interest rates at a certain rate or not, generative AI investment and investor appetite should turn capital markets within the next 12 months in our view. A catalyst that will likely create an upturn in LP sentiment, turning on the virtuous cycle all over again.

Spread Between Public and Private Markets Have Normalized from 2021-2022 LevelsSource: Coatue Management, Capital IQ, Dealogic; Includes US listed and SEC registered IPOs over $30M, along with 34 SPACs in 2021. As of July 2024 As we look out, we see a likely massive bifurcation with GP venture performance based on 1) overexposure (as a % of FMV) of 2021-2022 unicorns and 2) durable asset quality – defined as the persistence of revenue growth over time, matters more than the absolute pace of revenue growth or changes in valuation due to market conditions. What became a blind spot for many investors throughout this time was that absolute growth was mistaken as durable growth. When market turned countercyclical, overall CAGR growth began to dissipate as companies struggled to accelerate in more challenging market conditions. These non-durable assets are effectively "zombies" with *likely* zero terminal value. Even with a normalized capital markets environment, these assets will remain frozen, keeping DPI at a standstill for overexposed funds.

Historical Top Quartile IRR Performance for 2017-2022 VintagesSource: Pitchbook; As of 08.15.2024. Represents top quartile median IRR on quarterly basis from 2017 to Q1 2024