7GC II invests in poolside’s $500M Series B

We're excited to announce 7GC's participation in Paris-based Poolside's $500M Series B, led by Bain Capital Ventures.

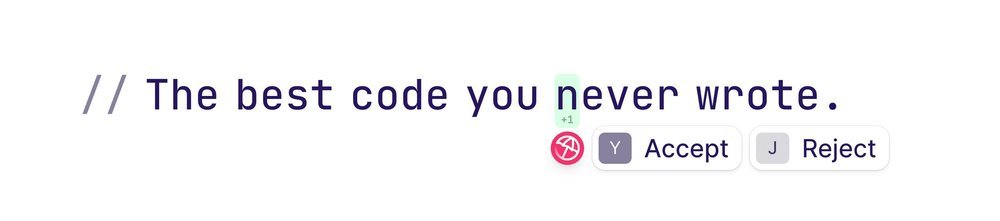

Poolside is an AI-powered platform focused on software development and coding automation

Like many other venture firms, we spent much of 2023 analyzing the market and ecosystem with Generative AI. We shared those viewpoints in our white paper last September, which, in many ways, framed our investment strategy within the space to date.

The hardware, infrastructure, and application layers are the three disparate technology layers for any new technology. Over the last twelve months, we have continued to see monumental innovative shifts in the infrastructure layer occur almost monthly. This, in our view, led to rapid implementation and testing across enterprises but still low actual deployments for application products, driving limited monetization.

This implementation and testing has driven massive revenue acceleration for hardware leaders (Nvidia) and the premier players within the LLM layer. This led us to our first Gen-AI investment into Anthropic Series D financing round led by Menlo Ventures.

Following that successful close in Q1, we have spent a significant period looking to identify a team and company that has put together a compelling application layer product and go-to-market strategy, which led us to this opportunity with Poolside AI.

Large Language Models (“LLMs”) are built around language, and coding is the most binary language in the world — the language of computers. This makes coding one of the most obvious use cases for LLMs. Poolside was founded to create the infrastructure and application layers to bridge the best generative AI practices into software development and coding applications.

7GC feels extremely confident in poolside's ability to bring this strategy live with some of the largest enterprise customers in the world this year.

The Problem

The "AI air pocket"—or better defined as the AI bubble— has been debated these past few months, given the limited revenue shown from the $200 billion in annual capex spend from hyper scalers into data center and GPU investment.

While we agree that sentient life / AGI remains in the distant future, there have been clear monetizable use cases and adoption for coding assistants already.

Github (acquired by Microsoft) CoPilot's suite stands out as the premier example. Github Copilot surpassed $100 million in ARR in just four quarters and has over 77K active customers today, representing over 180% YoY customer growth. The resounding feedback from developers is that this tool is already critical to their day-to-day.

This extremely high adoption from developers provides a ripe ground for competition in these early innings of generative AI. The question today is not if this will be adopted but who will win, driving our investment thesis from gray areas to black-and-white outcomes, specifically revolved around team and go-to-market.

While GitHub CoPilot proves market fit for the product category, it needs more product capabilities for large enterprise deployments.

While GitHub CoPilot today has $300 million in ARR, the 77,000 customers imply a relatively low median ACV of just $4,000 / per customer. This indicates a long tail of small deployments built via legacy seat licensing + self-serve model. This adoption is a win for the vertical; but it exacerbates that a pure-play "enterprise-grade" solution has yet to emerge as well.

GitHub CoPilot has also plateaued in reasoning capabilities for coding—something critical for the product to graduate solving more challenging problems and invariably increasing customer productivity.

Studies reviewed by 7GC indicated that 2023 showed churned code accelerated by 39.2%, and code that was moved decreased by 17.3% relative to 2022. If these trends continue on the same trajectory, more than 7% of all code will need to be reverted in 2024, double the rate pre-release of Github Copilot in 2021.

Enter Poolside

Unlike GitHub CoPilot and many other coding assistant products, Poolside is a fully verticalized solution. This product stack means Poolside has built out its own LLM open-source model from the ground up, which gives it complete visibility and control of what data is trained and how it is trained.

This strategy requires significant capital, talent, and computing resources. Poolside has been solving these risk factors since day one while executing at a phenomenal clip.

Poolside has built a family of three models, with Poolside Malibu being its primary - 69 billion parameter - model designed for optimal reasoning and fast inference. These models power its product suite, which includes Poolside Assistant, allowing developers to write, debug, and maintain software.

With this vertically integrated approach, the company has established the capabilities to provide best-in-class reasoning capabilities for software development to enterprises through an incredible go-to-market strategy.

As part of the company's announcement for this financing round, the company has established strong distribution partnerships across the hyperscaler ecosystem. These partnerships will allow the company to sell its products to hyperscaler cloud customers and garner dedicated global sales enablement and internal support teams.

Outside of hyperscaler sales enablement, the company has also built out its own internal go-to-market team led by Paul St. John, who previously was the VP of worldwide sales at Github and was responsible for ramping revenue from $8 million to over $500 million. During his time at the company, he also helped deliver 36 million registered users and over 60% of Fortune 50 companies signing to GitHub Enterprise. This two-headed go-to-market approach gives us incredible excitement about the company's sales pipeline over the next 12 months.

We are thrilled to partner with and continue supporting the entire poolside team, including Jason, Eiso, Paul, and Margarida. We are also excited to join other existing investors and partners, including Redpoint Ventures, DST Global, Felicis Capital, and Bain Capital Ventures.